Mortgage Rates 2025: Should You Refinance Now? Complete USA Guide

In 2025, mortgage rates are still making headlines across the United States. Homeowners are asking the same big question: Should I refinance now, or wait? With rates hovering in the mid-6% range and talk of Federal Reserve cuts ahead, this is the right time to evaluate your mortgage. In this article, we’ll explain the current trends, give you a step-by-step refinance guide, and even provide a free calculator to estimate your savings.

1. Current Mortgage Rates in USA (September 2025 Update)

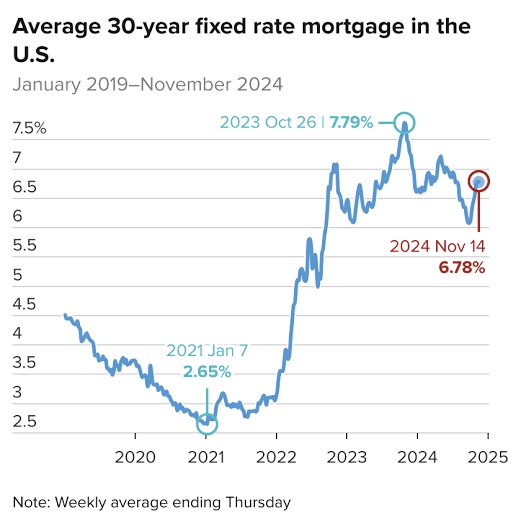

As of September 2025, mortgage rates remain above 6% for most borrowers. According to Bankrate’s mortgage tracker, the average 30-year fixed mortgage rate has been steady but slightly easing as inflation pressures cool. Housing sales, however, are still weak, which makes lenders more competitive in refinancing deals.

2. Should You Refinance Your Mortgage in 2025?

The golden rule: if your new rate is at least 0.75%–1.0% lower and you plan to stay in your home for at least 3 years, refinancing usually makes sense. Here’s a checklist:

- Find your current loan details: balance, rate, and term left.

- Get quotes from 2–4 lenders, including credit unions.

- Calculate the break-even point = (refinance costs ÷ monthly savings).

- If break-even is less than your expected stay, refinancing is worth it.

3. Free Mortgage Refinance Calculator

Use this simple calculator to estimate monthly savings:

4. Costs of Refinancing a Mortgage in 2025

Refinance isn’t free. Expect fees around 2%–4% of the loan amount, which may include:

- Appraisal fee

- Origination and lender fees

- Title search and recording charges

- Prepaid interest

5. Mistakes Homeowners Make When Refinancing

- Comparing only the interest rate, not the full APR.

- Ignoring closing costs.

- Extending the loan term and ending up paying more interest overall.

- Not checking credit score before applying.

6. Top Resources for Mortgage Refinance

Here are some trusted resources for further research:

- Investopedia Guide to Refinancing

- Consumer Finance Protection Bureau

- NerdWallet Refinance Lender Rankings

7. FAQs on Mortgage Refinancing in 2025

What rate makes refinancing worth it?

If your new rate is at least 0.75%–1% lower, refinancing is usually beneficial.

How long does refinancing take?

On average 30–45 days, depending on lender and paperwork.

Can I refinance with poor credit?

Yes, but you may face higher rates. Improving your credit first will maximize savings.

What if I plan to sell my home soon?

If you’ll sell in 1–2 years, refinancing might not cover costs before break-even.

Final Thoughts – Should You Refinance Your Mortgage in 2025?

For U.S. homeowners in 2025, refinancing is one of the smartest financial moves if approached correctly. Use the calculator above, compare at least 3 lenders, and always calculate your break-even point before signing. Done right, refinancing can free up hundreds of dollars monthly and create long-term stability for your family.