Personal Finance for Beginners in America: A Complete Guide

Introduction

Managing personal finances can feel overwhelming, especially for beginners in the United States. From student loans to credit cards, mortgages to retirement savings, the financial landscape is complex. This guide breaks down the essentials of personal finance for beginners, providing practical tips, strategies, and insights to help you take control of your money and build long-term financial security.

Why Personal Finance Matters

Personal finance isn’t just about saving money; it’s about creating freedom and security. Here’s why it matters:

- Financial Independence: Proper management allows you to make choices without relying on others.

- Stress Reduction: Knowing where your money goes reduces anxiety about bills, debt, and emergencies.

- Future Security: Smart financial planning ensures retirement readiness and emergency preparedness.

- Opportunities: Managing finances well opens doors for investments, education, and major life purchases like homes or vehicles.

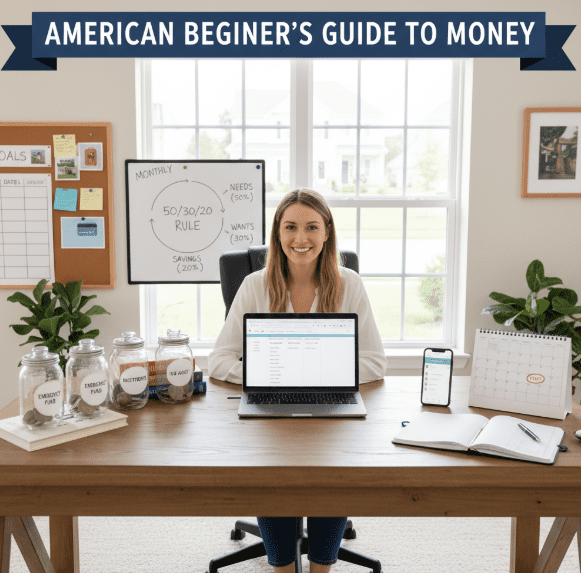

Step 1: Budgeting Basics

Budgeting is the foundation of personal finance. Start by:

- Tracking Income and Expenses: List all sources of income and monthly expenses. Apps like Mint, YNAB, or Personal Capital can help.

- 50/30/20 Rule: A popular guideline: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Automate Savings: Set up automatic transfers to savings or investment accounts each month.

- Review Regularly: Check your budget monthly and adjust based on changing needs.

Step 2: Building an Emergency Fund

An emergency fund is critical to handle unexpected expenses like medical bills, car repairs, or temporary unemployment. Recommendations for beginners:

- Start with $1,000 as a small emergency fund.

- Gradually aim for 3–6 months of living expenses.

- Keep the fund in a liquid, high-yield savings account for accessibility and growth.

Step 3: Understanding and Managing Debt

Debt is common in the U.S., but managing it effectively is essential. Key points:

- Good Debt vs Bad Debt: Good debt (like student loans or mortgages) can help build your future. Bad debt (high-interest credit cards, payday loans) can trap you financially.

- Pay More Than Minimum: Avoid only paying the minimum on credit cards to reduce interest costs.

- Debt Snowball vs Debt Avalanche: Snowball: pay off smallest debts first. Avalanche: pay off highest interest first. Both strategies work; choose what motivates you.

- Monitor Your Credit Score: Check your score regularly through Experian, TransUnion, or Equifax. A good score reduces borrowing costs.

Step 4: Saving and Investing

Saving is about security, investing is about growth. Beginners should understand both:

1. Retirement Accounts

Start early with retirement savings. Options include:

- 401(k): Employer-sponsored, often with matching contributions.

- Roth IRA: Tax-free growth on contributions after-tax.

- Traditional IRA: Tax-deductible contributions, taxed at withdrawal.

2. Investment Accounts

For non-retirement investing:

- Brokerage accounts for stocks, ETFs, and mutual funds.

- Robo-advisors like Betterment or Wealthfront for automated portfolio management.

- Diversify across sectors, asset classes, and geographies to reduce risk.

3. Importance of Compound Interest

Even small monthly investments grow significantly over time. Starting early is key: a $200 monthly investment at 7% annual return can grow to over $100,000 in 30 years.

Step 5: Smart Spending Habits

- Track spending using apps or journals.

- Differentiate between needs and wants; avoid impulse purchases.

- Use cash-back or rewards credit cards responsibly to gain benefits.

- Shop for deals, compare prices, and prioritize value over brand appeal.

Step 6: Insurance and Risk Management

Insurance protects you from financial shocks. Beginners should consider:

- Health Insurance: Essential in the U.S., explore ACA plans or employer coverage.

- Auto and Home Insurance: Required and protects valuable assets.

- Life Insurance: Consider term life insurance to protect dependents.

- Disability Insurance: Provides income in case of illness or injury.

Step 7: Financial Goals and Planning

Set clear short-term, medium-term, and long-term goals:

- Short-term: Emergency fund, paying off credit cards.

- Medium-term: Buying a home, saving for education.

- Long-term: Retirement, wealth accumulation.

Review and adjust your plan annually or as circumstances change.

Step 8: Leveraging Technology

Financial technology tools can simplify money management:

- Budgeting apps: Mint, YNAB, PocketGuard

- Investment apps: Robinhood, Fidelity, Vanguard

- Automated savings: Digit, Acorns

- Credit monitoring: Credit Karma, Experian

Common Mistakes to Avoid

- Ignoring budgeting and tracking expenses

- Accumulating high-interest debt without a repayment plan

- Delaying retirement savings

- Failing to diversify investments

- Not having adequate insurance coverage

Conclusion

Personal finance is a lifelong journey, but starting with these basics sets a strong foundation. By budgeting, saving, investing, managing debt, and protecting assets with insurance, beginners in America can gain financial security and build wealth over time. The key is consistency, discipline, and using available resources wisely. With proper planning, anyone can achieve financial independence and make informed decisions for a secure future.

[…] Experts view this as a classic case of excess in a frothy market. Post the April 2025 halving open interest ballooned to 150 billion dollars inviting reckless leverage. When sentiment flipped the inevitable purge ensued reminding participants that in crypto greed often precedes the fall. For tips on avoiding liquidation traps visit https://infinityxverse.com/personal-finance-for-beginners-in-america/ […]